Phase II Profit Program

2024 Quant Summit London

Goldman Sachs Experience

Toronto Trust Management Ltd. (TTML) is a Canada-based professional fund management and trustee services firm, dedicated to delivering fund management and regulatory compliance solutions for institutional and high-net-worth clients. Acting as both trustee and fund manager, TTML places strong emphasis on regulatory compliance to safeguard fund assets, ensure efficient and transparent operations, and collaborates closely with investment advisory teams to implement strategies in the Canadian market. As a strategic partner of Aksia LLC in Canada, TTML is committed to bringing world-class hedge fund research and quantitative investment expertise to the local market, establishing a wealth management platform that combines a global perspective with robust local regulatory assurance.

-

Image

TTML and Aksai Launch Phase III Profit Plan

Release Data: October 10, 2025

Release Data: October 10, 2025

Aksia LLC, in collaboration with Toronto Trust Management Ltd. (TTML), has officially launched the Phase III Profit Plan, marking a key step for Aksia in preparing for its 2026 Canadian hedge fund.

This phase introduces an upgraded AI quantitative trading system, integrating intelligent modeling, capital flow tracking, and risk control algorithms, aiming to achieve up to 600%cumulative returns within two months.

Michael M. France, Chairman of the Aksia Canadian Fund Advisory Committee, stated:“Phase III is not only a technological upgrade but also a reflection of our quantitative research and institutional development.Our goal is to validate the system’s robust performance with measurable results before the fund officially launches.”

-

Image

Aksia and TTML Launch “Aksia Elite Circle – TTML Rewards Program” to Expand Canadian Market Presence

Release Date: September 1, 2025

Release Date: September 1, 2025

To advance its localized development in Canada, Aksia has partnered with Toronto Trust Management Ltd. (TTML) to launch the “Aksia Elite Circle – TTML Rewards Program.”

This initiative combines learning and engagement to help investors deepen their understanding of quantitative trading and risk management, while offering both cash and tangible rewards. Members can earn periodic incentives through daily check-ins and course participation, with top performers eligible for luxury gifts and grand prizes.

The program marks the official rollout of Aksia and TTML’s collaboration in the Canadian market, providing investors with a new experience that integrates education with practical application.

-

Image

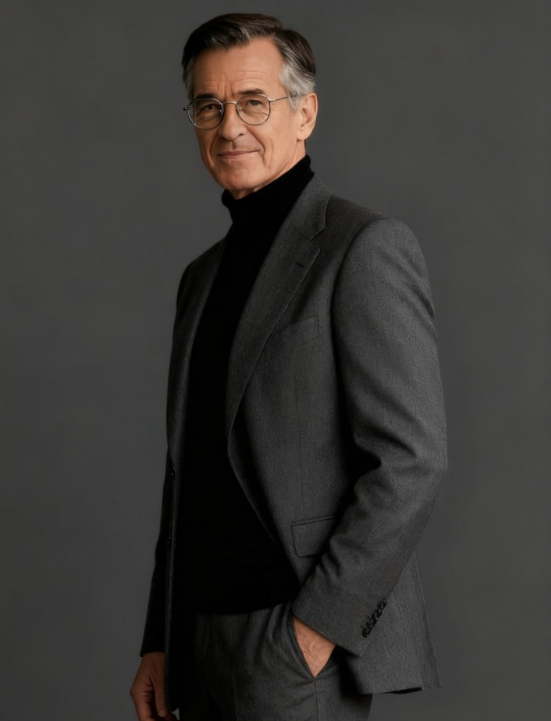

Michael M. France Appointed Chairman of Aksia’s Canadian Fund Advisory Board

Release Date: March 27, 2025

Release Date: March 27, 2025

Aksia has appointed veteran investor Michael M. France as Chairman of its Canadian Fund Advisory Board. In this role, he will oversee the preparation and compliance of Aksia’s first Canadian hedge fund and work closely with Toronto Trust Management Ltd. (TTML) to advance the firm’s localized strategic initiatives.

The partnership between Aksia and TTML combines global research expertise with local execution capabilities, ensuring the fund’s stability and regulatory compliance. This collaboration marks Aksia’s official entry into the Canadian market and lays a solid foundation for the fund’s planned launch in February 2026.

-

Image

TTML and Aksai Launch Phase III Profit Plan

Release Data: October 10, 2025

Release Data: October 10, 2025

Aksia LLC, in collaboration with Toronto Trust Management Ltd. (TTML), has officially launched the Phase III Profit Plan, marking a key step for Aksia in preparing for its 2026 Canadian hedge fund.

This phase introduces an upgraded AI quantitative trading system, integrating intelligent modeling, capital flow tracking, and risk control algorithms, aiming to achieve up to 600%cumulative returns within two months.

Michael M. France, Chairman of the Aksia Canadian Fund Advisory Committee, stated:“Phase III is not only a technological upgrade but also a reflection of our quantitative research and institutional development.Our goal is to validate the system’s robust performance with measurable results before the fund officially launches.”

Our role

Our role as a development finance institution is to stimulate inclusive and sustainable economic growth and development through financing to and investments in the private sector.

We look to mobilize private sector investment in developing markets to support our three development goals: gender equality, climate and nature action and market development.

Our role as a development finance institution is to stimulate inclusive and sustainable economic growth and development through financing to and investments in the private sector.

We look to mobilize private sector investment in developing markets to support our three development goals: gender equality, climate and nature action and market development.

We achieve this by focusing on three primary sectors: the financial industry, sustainable infrastructure and agribusiness, forestry and their value chains.

FinDev Canada offers financial solutions such as debt, equity and guarantees to clients operating in developing countries that demonstrate sustainable social and economic benefits for local communities.

We also offer non-financial support through our Technical Assistance Facility.

Our story

Recognizing the importance of the private sector, the Government of Canada established a bilateral Development Finance Institution. In 2015, the creation of a development finance institution was ratified by the parliament. The Government’s intention to launch a DFI is announced in the 2015 Economic Action Plan.

Recognizing the importance of the private sector, the Government of Canada established a bilateral Development Finance Institution. In 2015, the creation of a development finance institution was ratified by the parliament. The Government’s intention to launch a DFI is announced in the 2015 Economic Action Plan.

In January 2018, Canada’s development finance institution (Development Finance Institute Canada (DFIC) Inc. – or FinDev Canada) opened for business with a mandate to support the growth and sustainability of the private sector in developing markets.

FinDev Canada enabled Canada to complement its existing suite of international assistance tools and join its G7 partners in having a DFI supporting development through the private sector in developing countries.

The role of DFIs

In today’s increasingly complex world, development finance is needed more than ever to drive sustainable and inclusive economic growth. DFIs are an important tool in this regard, providing financial services aimed at growing the local private sector in developing countries.

In today’s increasingly complex world, development finance is needed more than ever to drive sustainable and inclusive economic growth. DFIs are an important tool in this regard, providing financial services aimed at growing the local private sector in developing countries.

The pandemic wiped out more than four years of progress on poverty eradication and pushed 93 million more people into extreme poverty in 2020.

Development finance institutions can help mobilize private capital by bridging knowledge gaps and offering blended finance opportunities that help crowd in private capital.

Climate and nature action

Climate and nature action is one of FinDev Canada’s three development impact goals and plays a key role in the realization of our mandate. We recognize that climate and nature action is a global systemic issue that disproportionately affects developing countries, especially women and other vulnerable populations.

Climate and nature action is one of FinDev Canada’s three development impact goals and plays a key role in the realization of our mandate. We recognize that climate change is a global systemic issue that disproportionately affects developing countries, especially women and other vulnerable populations.

DFIs can help facilitate the transition to a low-carbon economy by mobilizing and directing capital to support decarbonization. We recognize that actions on climate change mitigation, adaptation and resilience represent a multi-trillion dollar investment opportunity with multiple co-benefits, such as job creation, economic stability and innovation.

We actively seek investments that contribute to the reduction of greenhouse gas emissions, the protection of biodiversity and the increase of adaptation and resilience measures in our target geographies, which are among the most vulnerable regions to the effects of climate change.

Gender equality

Gender equality is a strategic priority for FinDev Canada. As a DFI working through the private sector, we see women's economic empowerment as the primary mode through which we can contribute to achieving gender equality.

Gender equality is a strategic priority for FinDev Canada. As a DFI working through the private sector, we see women’s economic empowerment as the primary mode through which we can contribute to achieving gender equality.

We apply a gender lens to all our transactions and consider this approach as a key enabler of our objective to reduce poverty and achieve a more stable and prosperous future, but also as an asset to drive business performance in our portfolio.

We target investments in businesses that are owned or led by women, businesses that provide decent work to women, businesses that provide women access to basic services and economic empowerment tools, as well as funds or financial intermediaries supporting these businesses.

Our commitments

Our approach to development impact is aligned with the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement.

Our approach to development impact is aligned with the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement.

The COVID-19 pandemic, global conflicts, the economic turndown, social unrest and global climate stresses all had negative effects in achieving the SDGs.

On climate finance, we need at least USD 4.3 trillion in annual finance flows by 2030 to avoid the worst impacts of climate change.

Learn more about the contribution we have on the SDGs in our portfolio dashboard.

Consult previous events by selecting the "Show Past events" filter above.

Consult previous events by selecting the "Show Past events" filter above.

Toronto Trust Management Ltd. (TTML) is incorporated in Ontario under the Ontario Business Corporations Act and focuses on fund operations and compliance management. As an Investment Fund Manager, TTML is registered under Canadian securities regulation NI 31-103 with the Ontario Securities Commission (OSC) and other provincial regulators, with NRD number 33690. Fund distribution and trade execution are carried out by licensed brokers and dealers regulated by the Investment Industry Regulatory Organization of Canada (IIROC). TTML remains committed to compliance and prudence, leveraging Canada’s robust regulatory framework and custodial arrangements to provide institutional and high-net-worth clients with reliable fund management and compliance services.

Michael M. France, a Canadian national and CFA charterholder (awarded October 4, 2000), currently serves as Managing Partner of Toronto Trust Management Ltd. (TTML) and Chair of the Aksia Canada Fund Advisory Committee. He is responsible for overseeing fund compliance, establishment, and operations in the Canadian market, ensuring adherence to local regulatory requirements while supporting Aksia’s strategic initiatives in Canada and serving the needs of local investors.